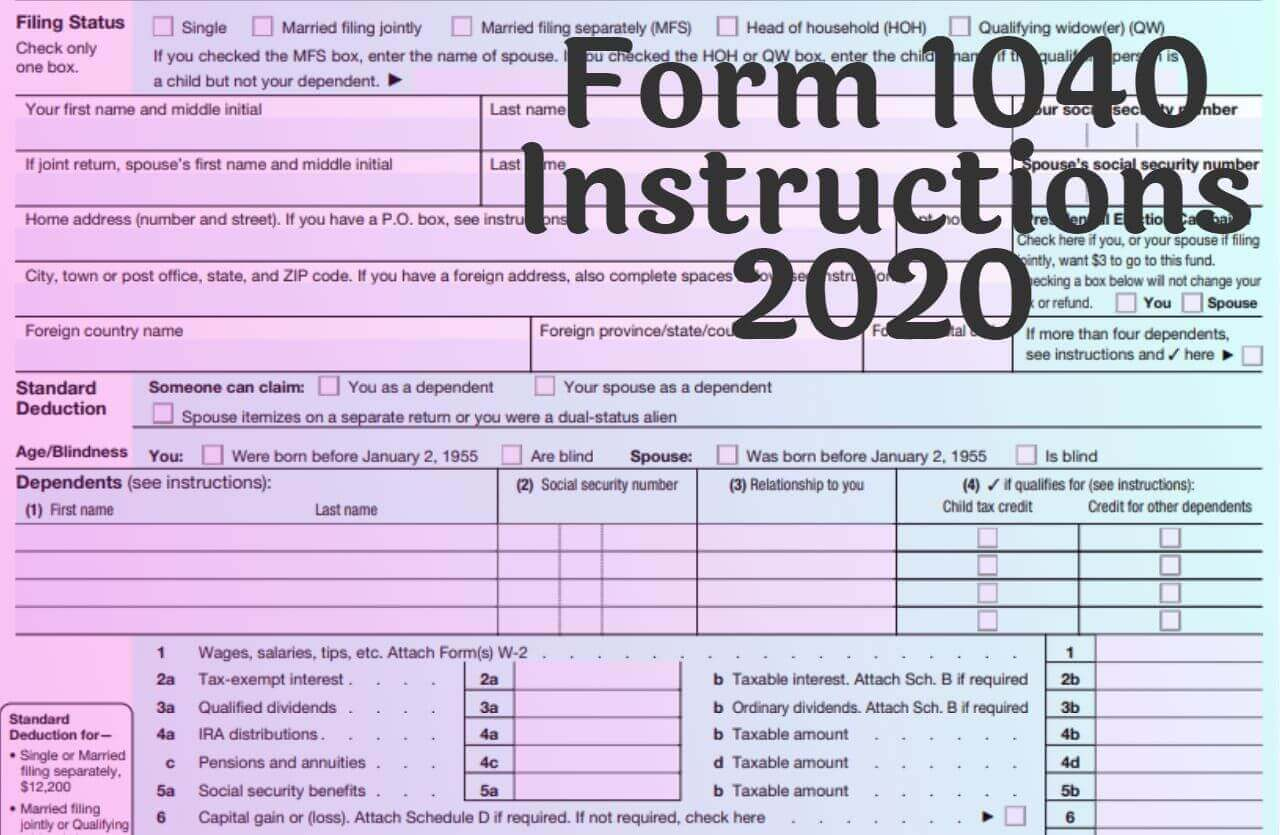

When you click on your selected form, the file will open in Adobe Acrobat and you will see a cursor that is shaped like a hand. There is no computation, validation or verification of the information you enter, and you are fully responsible for the accuracy of all required information. Maryland fill-out forms use the features provided with Acrobat 3.0 products.

To do so, you must have the full Adobe Acrobat 4.1 (or newer) product suite, which can be purchased from Adobe. IMPORTANT: The Acrobat Reader does not allow you to save your fill-out form to disk. Fill-out forms are better than hand written forms because they offer a cleaner and crisper printout for your records and are easier for us to process. You can also print out the form and write the information by hand.

You must have the Adobe Acrobat Reader 4.1 (or newer), which is available for free online. A phone call is necessary in this situation because of the private and confidential nature of the 1095B form.Fill-out forms allow you to enter information into a form while it is displayed on your computer screen and then print out the completed form. If you have had an address change in 2019 or 2020, please call customer care to request a printed copy of the 1095B. If you have any questions about your Form 1095-B, contact UnitedHealthcare by calling the number on your ID card or other member materials.

Members living in states with laws that require reporting of health coverage will continue to receive a paper copy of the Form 1095-B for state filing tax purposes. Therefore, individuals no longer need the information on the Form 1095-B to file a federal income tax return. Under new law that became effective beginning with the 2019 tax year, the IRS penalty for not having health coverage was reduced to zero. Most fully insured UnitedHealthcare members will no longer automatically receive a paper copy of the Form 1095-B due to a change in the tax law.

0 kommentar(er)

0 kommentar(er)